NY Workers’ Comp e-Billing: What Providers Need to Know

After August 1, the Workers’ Compensation Board (WCB) will not take any action to enforce payment of non-electronic bills.

Translation: if you continue to bill on paper, the payer may refuse to reimburse your practice.

New York’s e-billing mandate includes specific requirements that every practice treating injured workers must know and adhere to.

Below are the most important details.

We’d love to hear from you - even if you're not ready to try daisyBill just yet. Our experts are here to help all providers navigate workers' comp billing, so send your questions or feedback and we’ll be in touch ASAP 🚀

-

Choosing an XML Submission PartnerLearn More

Choosing an XML Submission PartnerLearn MoreIn addition to submitting bills to the payer electronically, providers must submit bill data to the WCB electronically in the mandatory XML format.

To adhere to this requirement, providers must select one of 6 approved XML Submission Partners listed on the WCB website. All providers treating injured workers in New York must bill through one of these 6 entities.

-

Registering for e-Billing on the WCB Medical PortalLearn More

Registering for e-Billing on the WCB Medical PortalLearn MorePrior to July 28, 2025, providers must log into the WCB Medical Portal and accept the “Agreement for electronic submission of CMS-1500” before working with an XML Submission Partner. Starting July 28, providers may skip this step and instead contact an approved XML Partner to get started.

-

All Payers Must Accept Electronic CMS-1500 Submissions (and Return Electronic EORs/EOBs)Learn More

All Payers Must Accept Electronic CMS-1500 Submissions (and Return Electronic EORs/EOBs)Learn MoreJust as providers must bill electronically, all payers—insurers, self-insured employers, TPAs, etc.—have no choice but to accept compliant electronic bills from providers. This requirement is universal; any payer that claims not to accept e-bills is in violation of New York law and regulations.

Additionally, all payers must send providers electronic Explanations of Review/Benefits in response to e-bills, which automatically upload payment details to the practice’s e-billing system.

-

Offsetting the Cost of e-Billing: Code 99080Learn More

Offsetting the Cost of e-Billing: Code 99080Learn MoreTo help offset the cost of billing electronically, the WCB allows providers to bill payers up to $1 per e-bill using code 99080. Providers must apply 99080 to each e-bill with a charge that accurately reflects the cost to the practice of submitting the bill electronically.

Payers must reimburse valid 99080 charges. In the event a payer fails to reimburse for 99080, the WCB requests the provider gather several examples and report them directly to the WCB—do not file an HP1 for a missing 99080 payment. Note: for NY daisyBill clients, our software will automatically track 99080 denials and report them to the WCB.

-

e-Billing for MMI/PPILearn More

e-Billing for MMI/PPILearn MoreThe CMS-1500 is now the required billing form for Maximum Medical Improvement/Partial Permanent Impairment opinions. However, the C-4.3 form is still in use—it just serves a new role.

Providers should now use the C-4.3 as the required narrative report for MMI/PPI opinions. Submit the C-4.3 as an attachment to the CMS-1500, but never on its own.

-

Clearinghouses vs e-Billing SoftwareLearn More

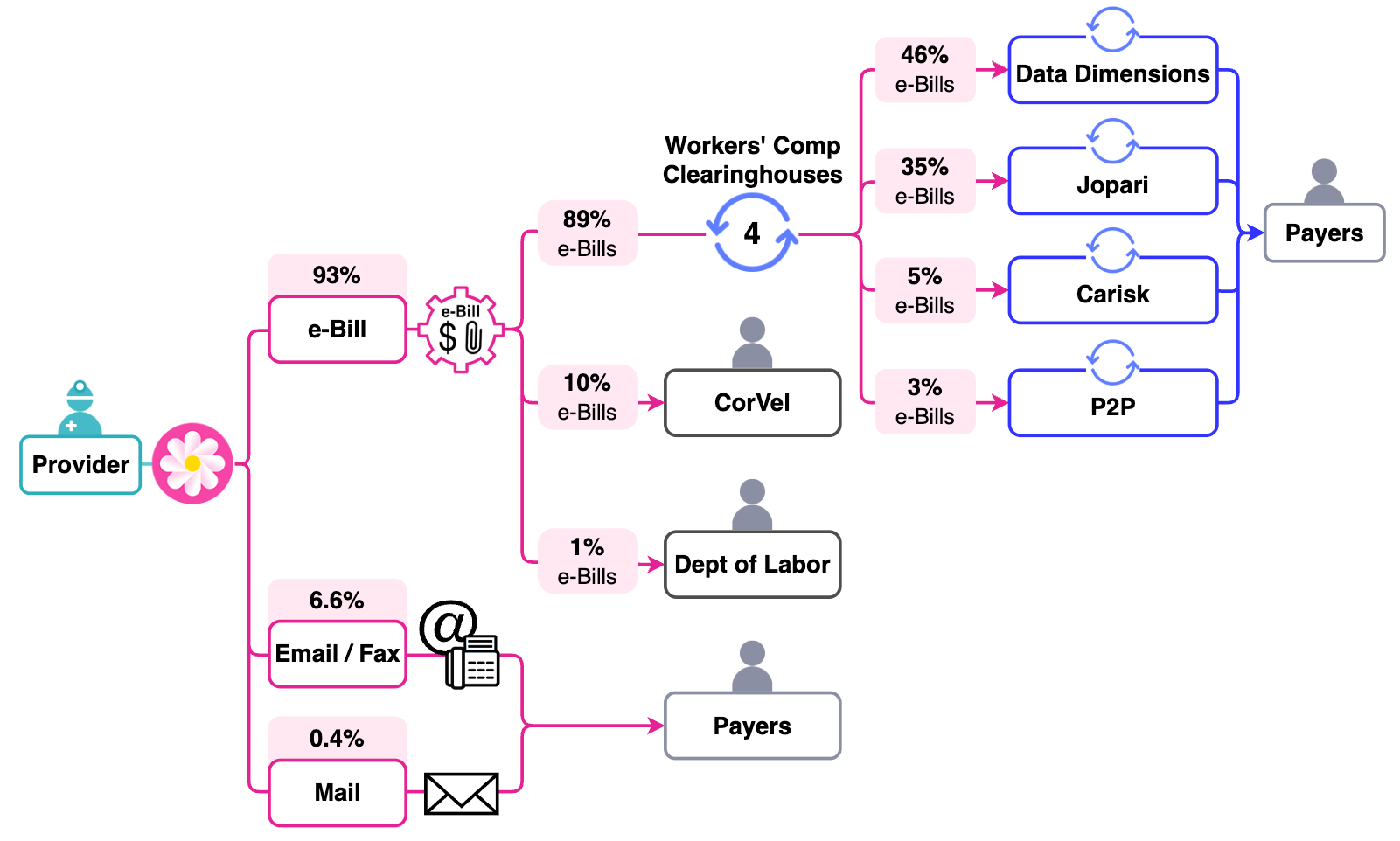

Clearinghouses vs e-Billing SoftwareLearn MoreAs noted above, New York providers must e-bill through one of 6 WCB-approved XML Submission Partners. The catch: some of these Partners are clearinghouses—entities whose only function is to transmit e-bills to certain payers, which are clients of theirs.

Each payer designates its own clearinghouse. If your chosen XML Submission Partner is a clearinghouse, but not the payer’s designated clearinghouse, your e-bill has to be rerouted to the correct clearinghouse—and that’s where things can go wrong.

Supporting documentation can be lost.

e-Bills can go “missing.”

Payments can get delayed.

That’s why using end-to-end e-billing software—not just any single clearinghouse—can make a major difference. Psst: daisyBill has direct connections to all major clearinghouses.

-

Need More Help?Say Hi!

Need More Help?Say Hi!Our experts are happy to help any provider with questions about e-billing—whether they’re a client or not.

Whether you’re considering daisyBill as your approved XML Submission Partner, or simply need guidance and clarification, we’re here for you.

-

Loving daisyBill! Easy to enter bills, and I get a faster turn around on payment and/or denial! We are seeing our payments coming in much faster and ...the support staff is wonderful. I always get an answer in 10 minutes are less!!Learn More

Loving daisyBill! Easy to enter bills, and I get a faster turn around on payment and/or denial! We are seeing our payments coming in much faster and ...the support staff is wonderful. I always get an answer in 10 minutes are less!!Learn More- Lisa Mace, Newark, DE, Happy daisyBiller since January 2024

-

"Processing bills for multiple clients was a nightmare, but daisyBill made everything fast and easy. Payments come in like clockwork."Learn More

"Processing bills for multiple clients was a nightmare, but daisyBill made everything fast and easy. Payments come in like clockwork."Learn More— Monica Biery, Sacramento, CA, Happy daisyBiller since 2016