CA State Fee Schedule vs Provider Reimbursement

California’s Official Medical Fee Schedule (OMFS) — also called the state fee schedule — sets the reimbursement rates for medical treatment provided to injured workers. However, Preferred Provider Organizations (PPOs) and other discount networks often drive reimbursements paid to providers far below these state fee schedule rates.

Medical Provider Networks (MPNs) frequently pressure providers to sign these PPO discount contracts by threatening exclusion from the MPN if the provider refuses to sign a reduced-rate contract.

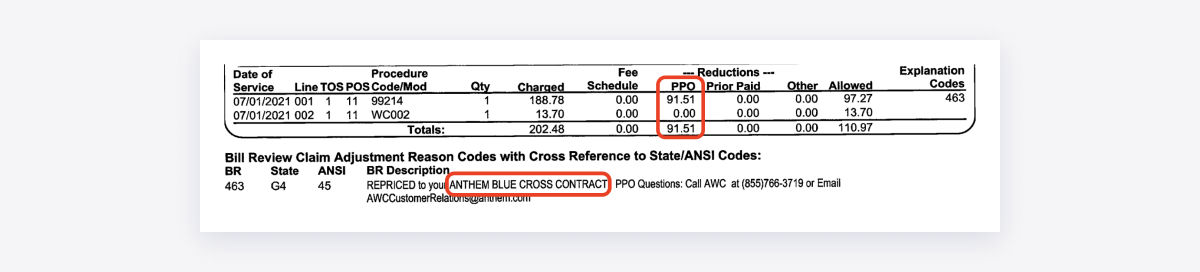

Once a provider signs a contract, PPOs typically sell or lease the discounted rates to other PPOs and the bill review vendors hired by payers. Those vendors then apply the discounts across countless bills — often for payers without a direct relationship with the MPN.

As a result, providers regularly receive Explanations of Review (EORs) showing reduced payments based on “leased” discount contracts.

These discounts create a revenue management nightmare for providers, discouraging them from treating injured workers.

The data below reflects the EORs that payers transmit electronically to daisyBill providers. This dataset includes bills with dates of service on or after January 1, 2022.

This data is updated daily.

CA State Fee Schedule Reimbursement Reductions

CA Workers' Comp Health Care Providers

For each CA daisyBill provider, this summary shows actual reimbursements compared to the state workers’ comp fee schedule. The data calculates:

Fee Schedule Due: The reimbursement amount required by the state fee schedule

Amount Paid: The reimbursement amount payers actually remitted

Balance Due: The unpaid difference between the state fee schedule and the actual payment

Fee Schedule % Paid: The percentage of the state fee schedule amount that providers ultimately received

This section exposes how PPOs, bill review vendors, and payers systematically reimburse providers below the state fee schedule, stripping away millions in reimbursements due to providers under California’s state fee schedule.

Procedure Codes

For each procedure code, this summary compares the state workers’ comp fee schedule due to providers versus the amount payers actually reimbursed providers. The data calculates:

Fee Schedule Due: The reimbursement amount required by the state fee schedule

Amount Paid: The reimbursement amount payers actually remitted

Balance Due: The unpaid difference between the state fee schedule and the actual payment

Fee Schedule % Paid: The percentage of the state fee schedule amount that providers ultimately received

Procedure codes are the standardized billing codes for specific medical services, such as an office visit with a physician or a physical therapy session.

This section demonstrates that payers consistently underpay providers who treat injured workers, depriving them of millions owed under California’s state fee schedule.

CA State Fee Schedules

The California Official Medical Fee Schedule (OMFS) — the state’s workers’ comp fee schedule — is divided into seven separate fee schedules. daisyBill providers submit bills for five of these fee schedules (daisyBill does not support inpatient hospital or ambulance bills).

This summary compares the amount due to providers under each fee schedule versus the amount payers actually reimbursed providers.

daisyBill Reimbursement Data Explained

When a provider submits a workers’ comp bill electronically to California payers, state regulations require the payer to send back an electronic EOR that complies with Division of Workers’ Compensation (DWC) requirements.

The data above reflects the EORs that payers transmit electronically to daisyBill providers. This dataset includes:

Bills with dates of service on or after January 1, 2022

Each procedure for which the payer issued a compliant electronic EOR

Note: The dataset does not include procedures where the payer denied payment in full ($0 reimbursement). daisyBill updates this data daily.